Like any international travel, a trip to Vietnam involves potential risks. While generally safe, unforeseen events like lost baggage at Tan Son Nhat International Airport, a sudden illness requiring medical attention, or a missed connecting flight can occur. This is where Vietnam Travel Insurance becomes crucial for Indian tourist. It acts as a vital financial safety net, protecting you against unexpected expenses and ensuring your adventure through this beautiful Socialist Republic of Vietnam remains enjoyable and stress-free.

Exploring the rich culture, vibrant cities, scenic islands, and breathtaking mountains of Vietnam is a dream for many Indian travellers, and a good policy ensures that dream isn’t derailed by unforeseen disruptions.

Why is Vietnam Travel Insurance Crucial for Your Vietnam Trip from India?

While not always mandatory for a Vietnam visa, securing Vietnam Travel Insurance is highly recommended for a safe and stress-free journey from India. It acts as a safeguard against unexpected events that could disrupt your adventure. From medical emergencies with potentially high healthcare costs to trip cancellations, loss of passport, baggage loss/delay, and missed flights, travel insurance protects you from financial loss and ensures a smoother travel experience. Many policies also offer COVID-19 Coverage, addressing potential medical expenses and trip disruptions related to the pandemic. By mitigating the impact of these risks, the right policy allows you to explore Vietnam with confidence and peace of mind.

Understanding the potential financial implications of such unforeseen events is key. While budgeting for your adventure, considering the overall Vietnam trip cost India, factoring in a small amount for comprehensive travel insurance can save you from significant expenses later on.

Understanding Vietnam Travel Insurance: Core Components & Providers

A. What is Vietnam Travel Insurance?

Vietnam Travel Insurance is a specialized policy designed to protect travellers from financial losses due to a wide range of unforeseen events that can occur during their trip to Vietnam. It essentially acts as a financial safety net, covering various travel-related risks, be it for a leisure trip, business, or education.

B. Key Features & Coverage Scope

Key features of Vietnam Travel Insurance often include:

- Comprehensive Coverage: Financial protection can be significant. For instance, TATA AIG offers policies with financial protection up to $250,000 per traveller, while HDFC ERGO provides overall coverage amounts ranging from $40K to $1000K. This covers medical emergencies, journey-related issues, and baggage problems.

- Medical Coverage: This is a cornerstone, covering hospitalization, emergency medical evacuation, and repatriation if needed.

- Journey Coverage: Protection against trip cancellation or interruption, and flight delays.

- Baggage Coverage: Covers loss or delay of checked-in baggage.

- COVID-19 Protection: Many modern policies explicitly cover medical expenses arising from a COVID-19 diagnosis during the trip.

- Cashless Benefits: Many insurers, like HDFC ERGO with its network of over 1 Lac partner hospitals worldwide, offer cashless claim facilities for medical treatment at network hospitals.

- 24×7 Customer Support/Emergency Assistance: Round-the-clock help is crucial in unfamiliar territory.

- Some providers, like Bajaj Allianz General Insurance, may offer policies with no deductibles.

C. Types of Plans & Eligibility Criteria

Insurers offer various plans to cater to different traveller needs:

- Individual Plans: Designed for solo adventurers.

- Family Plans: Cover multiple family members under a single policy. For example, TATA AIG offers family coverage for up to 6 members.

- Student Plans: Specifically for students heading to Vietnam for educational purposes.

- Multi-Trip Plans: Ideal for frequent flyers, covering several trips within a specified period.

- Senior Citizen Plans: Tailored to the needs of older travellers, offering specialized coverage.

- Eligibility: Typically based on age (TATA AIG, for instance, offers coverage for individuals as young as 3 months old), trip duration, and destination. Adults are generally between 18 and 70 years, and dependent children up to 25 years.

What’s Covered? Inclusions in a Typical Vietnam Travel Insurance Policy

While comprehensive, travel insurance policies have specific inclusions. Understanding these helps you choose the right coverage.

A. Medical Coverage

- Emergency Medical Expenses: This covers hospitalization, room rent, OPD treatment, and road ambulance costs. It also often includes expenses for Emergency Medical Evacuation, Medical Repatriation, and Repatriation of mortal remains. For example, TATA AIG covers medical expenses for injury or illness up to the sum insured (e.g., $250,000), often with a small deductible like $100.

- Pre-existing Diseases (PED): Some policies offer limited coverage for life-threatening emergency conditions arising from pre-existing diseases. TATA AIG, for example, covers PED up to $10,000.

- Emergency Dental Expenses: Covers acute dental pain or injury.

- Hospital Cash Allowance: A per-day benefit for extended hospitalization.

- COVID-19 Related Hospitalization and Treatment: A crucial inclusion in current times.

B. Journey-Related Coverage

- Trip Cancellation / Curtailment: Reimburses non-refundable expenses if your trip is cancelled or cut short due to covered reasons. TATA AIG might cover flight cancellation expenses up to $75.

- Flight Delay: Compensation for significant delays. For example, TATA AIG provides up to $45 for flight delays, while Bajaj Allianz may offer ₹500 to ₹1,000 for flights delayed by four hours or more.

- Loss of Passport: Covers expenses incurred in obtaining a duplicate or new passport if yours is lost or stolen during the trip. TATA AIG offers coverage up to $250 for this.

- Missed Flight Connection: Covers expenses due to a missed connecting flight.

- Hijack Distress Allowance: Provides compensation in the unfortunate event of a hijack.

C. Baggage-Related Coverage

- Loss/Delay of Checked-In Baggage: Reimburses for the purchase of essential personal belongings if your baggage is lost or delayed by the airline for a specified period. TATA AIG offers coverage up to $300 for this.

- Theft of Baggage: Covers the loss of baggage due to theft.

D. Other Important Coverage

- Accidental Death and Dismemberment: Provides a lump sum compensation in case of accidental death or permanent disablement during the trip. TATA AIG may offer up to $15,000.

- Personal Accident (Common Carrier): Similar coverage if the accident occurs while on a common carrier.

- Third-Party Liability: This is a vital coverage that protects you if you accidentally cause injury to a third person or damage their property, covering legal expenses. TATA AIG offers coverage up to $200,000 for third-party liability.

Depending on the type of travel insurance, each company and the package you choose, you will enjoy different benefits. It’s crucial to read the policy wording carefully.

What’s Not Covered? Common Policy Exclusions

It’s equally important to understand what your Vietnam Travel Insurance typically does not cover:

- Medical Exclusions:

- Undeclared Pre-existing diseases (beyond specified emergency limits).

- Sexually transmitted conditions.

- Cosmetic procedures (unless medically necessary due to an accident covered by the policy).

- Routine check-ups or preventative care.

- Treatment for mental disorders is often excluded by providers like TATA AIG.

- Maternity-related expenses.

- Self-Harm & Medical Negligence: Claims arising from suicide, attempted suicide, self-inflicted injuries, or travelling against medical advice.

- War & Intoxication-Related Losses: No coverage for injuries or losses caused by war, riots, civil commotion, criminal acts, intoxication from alcohol or unprescribed drugs, or accidents related to military service.

- Illegal & Hazardous Activities: Losses due to illegal actions, participation in hazardous activities or sports not specifically covered by the policy, terrorism (unless specifically included), or exposure to nuclear materials.

- Consumption of intoxicants or banned substances.

- Breach of Law.

- Negligence: Not taking reasonable care to protect your belongings.

Remember, this list provides a general overview. It’s crucial to carefully review the complete policy document provided by your chosen insurer to understand all specific exclusions.

Buying and Claiming Travel Insurance from India

What are the eligibility criteria for Travel Insurance in Vietnam?

While there are no “particular” eligibility criteria just for Vietnam, general requirements for purchasing travel insurance from India include:

- Adults should typically be between the ages of 18 and 70 (though some plans cover older seniors, and TATA AIG can cover infants from 3 months old).

- Dependent children can often be covered up to the age of 25.

- Travellers must possess and furnish mandatory documents like copies of passports, visas (if obtained), and sometimes income proof or other relevant papers as required by the insurer. Read more: Guide to get Vietnam Visa for Indian

Purchasing Vietnam Travel Insurance from India is straightforward, often through a paperless online purchase process:

- Compare: Use online comparison tools or visit the official websites of reputable insurers like TATA AIG, HDFC ERGO, or Bajaj Allianz.

- Select: Choose Vietnam as your destination, enter your travel dates, number of travellers, and purpose of the trip. Select a plan (individual, family, single-trip, or multi-trip) that best suits your needs and budget.

- Provide Details: Fill in the necessary personal information for all travellers.

- Pay: Complete the premium payment online using accepted methods (credit/debit card, net banking, UPI).

- Receive Policy: Your policy documents will usually be emailed to you instantly.

When to Buy? It’s highly recommended to buy your travel insurance as soon as you book your flights and accommodation. This ensures you’re covered for trip cancellation benefits if something unexpected happens before your departure date.

How to Claim

The claim process generally involves these steps:

- Inform Insurer ASAP: In case of an emergency or event leading to a claim, contact your insurer’s emergency assistance or claims department immediately or as soon as possible. Contact details (Phone/Email) will be in your policy document. For example, TATA AIG can be reached at +91-022 68227600 or EA.TATAclaims@europ-assistance.in.

- Provide Details: Have your policy number, a description of the incident, travel dates, and location ready.

- Submit Documents: Send all necessary supporting documents (e.g., medical reports and bills for medical claims, police reports for theft, baggage irregularity reports from airlines, passport copy, visa copy, boarding pass) as requested by the insurer, usually via email or an online portal.

- Verification & Settlement: The insurer will verify the submitted documents and process the claim. Approved claim amounts will be reimbursed as per the policy terms. Some insurers like TATA AIG aim for an expedited claim settlement process, often within 30-45 days. HDFC ERGO is known for its 24×7 customer support for claims, and Bajaj Allianz might even offer a missed call service for claim registration.

Essential Vietnam Visa Information for Indian Citizens

Yes, Indian citizens require a visa to enter Vietnam. Here’s what you need to know:

- Types of Vietnam Visas: Common types include Tourist (DL), Business (DN), Student (DH), Work (LD), Diplomatic (NG), Transit, and Investor (DT). For tourism, the Tourist Visa (DL) is applicable, typically valid for up to 30 days, or up to 90 days if obtained as an e-Visa.

- Vietnam E-Visa System:

- Indian citizens can apply online through the official Vietnam e-Visa portal.

- The e-Visa is generally valid for up to 90 days for a single entry.

- The approximate fee is USD 25 for a single entry and USD 50 for a multiple-entry (valid for 3 months) e-Visa.

- Visa on Arrival (VOA): This is possible for Indian passport holders, but it requires a pre-approval letter obtained online through an authorized agency before travel. You then get the visa stamp upon arrival at designated Vietnamese international airports.

- Embassy/Consulate Application: You can also apply through the Vietnam Embassy or Consulate in India.

- Documents Required for Vietnam Visa (General):

- A accurately filled out and signed visa application form.

- A valid passport with at least six months of validity remaining from your date of entry into Vietnam and at least two blank pages.

- Recent passport-sized colored photographs (e.g., 4×6 cm).

- Proof of travel arrangements (e.g., round-trip flight tickets).

- Proof of accommodation in Vietnam (e.g., hotel bookings).

- A bank statement or similar document to show you can manage your finances.

- Proof of visa fee payment.

- For e-Visa applicants, the approval letter is crucial.

- While not always mandatory for the visa application itself, having travel insurance for Vietnam visa purposes can be beneficial and is highly recommended for entry and stay.

Navigating Vietnam: Practical Tips for Indian Tourists

A. Safety and Precautions:

- Always carry copies of your important documents: passport, visa, and your Vietnam Travel Insurance policy. Keep originals secure.

- Familiarize yourself with and respect local laws, customs, and traditions. Dress modestly when visiting religious sites.

- Be aware of your surroundings, especially in crowded markets and tourist hotspots, to safeguard against pickpockets.

- Ensure your routine vaccinations are up-to-date before travelling. Consider vaccinations for Hepatitis A and Typhoid.

- Be cautious with street food; ensure it’s freshly cooked.

B. Fast Facts About Vietnam:

- Official Name: Socialist Republic of Vietnam

- Capital City: Hanoi

- Official Language: Vietnamese (English is spoken in tourist areas). Knowing a few basic phrases in the local language in Vietnam can greatly enhance your interactions and show respect for the culture.

- Currency: Vietnamese Dong (VND). You can check exchange rates on the State Bank of Vietnam website.

- Timezone: Indochina Time (GMT+7)

- National Dish: Pho (a delicious noodle soup)

- National Costume: Ao Dai (a traditional long gown)

- Number of UNESCO sites: 8

- Lucky Symbol: Tortoise

C. Best Time to Visit Vietnam:

- North Vietnam (Hanoi, Halong Bay): March to April or September to November for pleasant weather.

- Central Vietnam (Hue, Hoi An): February to August.

- South Vietnam (Ho Chi Minh City, Mekong Delta): December to May for the dry season.

- Understanding the regional variations is important; for a deeper dive into what to expect, learn more about Vietnams weather patterns across different seasons.

D. International Airports in Vietnam:

Major international airports include Noi Bai International Airport (HAN) in Hanoi, Tan Son Nhat International Airport (SGN) in Ho Chi Minh City, Da Nang International Airport (DAD) in Da Nang, Cam Ranh International Airport (CXR) for Nha Trang, and Phu Quoc International Airport (PQC).

E. Popular Destinations:

- Hanoi: Explore the Old Quarter, Hoan Kiem Lake, Temple of Literature, and Ho Chi Minh Mausoleum. Don’t miss a traditional water puppet show.

- Ho Chi Minh City (Saigon): Visit the War Remnants Museum, Cu Chi Tunnels, Reunification Palace, and Ben Thanh Market.

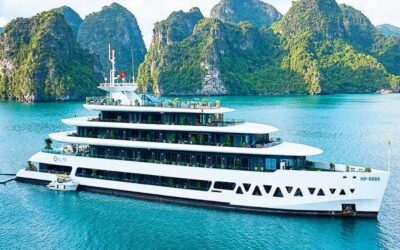

- Ha Long Bay: A UNESCO World Heritage site known for its stunning limestone karsts and emerald waters. Enjoy an overnight cruise and explore caves like Hang Sung Sot.

- Hoi An: Another UNESCO site, this ancient trading port charms with its lantern-lit streets, tailor shops, and Japanese Covered Bridge.

- Sapa: Famous for its terraced rice fields, trekking opportunities, and vibrant ethnic minority cultures in the Hoang Lien Mountains.

- Phong Nha-Ke Bang National Park: Home to some of the world’s most spectacular caves.

- Nha Trang: A popular coastal city with beautiful beaches, ideal for snorkelling and scuba diving.

- Mekong Delta: Experience floating markets and the local way of life.

- Hue: The former imperial capital with its historic citadel, royal tombs, and pagodas.

F. Money Saving Tips:

- Travel during the shoulder or low season (May to September) for better deals.

- Use local transportation like buses and trains.

- Enjoy affordable and delicious Vietnamese street food from local markets.

- Opt for budget-friendly accommodations like hostels or guesthouses.

- Book flights and accommodations in advance.

- Crucially, buy Vietnam Travel Insurance to avoid potentially massive costs from medical emergencies or lost baggage.

G. Indian Restaurants in Vietnam:

You can find Indian cuisine in major cities. Some well-known names include Dalcheeni, Saigon Indian Restaurant, Shanti Indian Cuisine, and Dahi Handi Indian Restaurant, mostly located in Ho Chi Minh City.

H. Indian Embassy in Vietnam:

Keep the contact details of the Indian Embassy in Hanoi handy for any assistance:

- Address: 58-60 Tran Hung Dao Street, Hoan Kiem District, Hanoi, Vietnam

- Present Ambassador: Mr. Pranay Verma

- Emergency Telephone number: +84-913089165 / +84-915989065

- Email: cons.hanoi@mea.gov.in / pptvisa.hanoi@mea.gov.in

- Website: https://www.indembassyhanoi.gov.in/

- Working hours for Consular Services: Monday to Friday – 0930 to 1230 hrs.

Frequently Asked Questions (FAQs)

- Is Vietnam Travel Insurance mandatory for Indian citizens?While not always a strict mandatory requirement for the Vietnam visa for Indian citizens, it is highly recommended. Some circumstances or specific visa types might imply the need, and it’s essential for financial safety during your trip.

- What is the typical premium cost for Vietnam Travel Insurance from India?The premium cost varies based on factors like the traveller’s age, duration of the trip, the chosen coverage scope, and the insurer. It’s best to get quotes from different providers.

- Does Vietnam Travel Insurance cover COVID-19 related medical expenses?Many comprehensive travel insurance policies available in India now include coverage for medical expenses if you contract COVID-19 during your trip to Vietnam. Always check the policy wording for specifics.

- How do I choose the best travel insurance policy for Vietnam?Compare policies based on coverage scope (especially for medical emergencies, trip cancellation, baggage), policy exclusions, premium cost, the insurer’s reputation for claim settlement, and customer service. Ensure it meets your specific travel needs.

- Are pre-existing conditions covered by Vietnam Travel Insurance?Generally, routine treatment for pre-existing conditions is excluded. However, some policies, like those from TATA AIG, may offer limited coverage (e.g., up to $10,000) for acute, life-threatening emergencies arising from a PED. It’s crucial to declare any PEDs when buying the policy and understand the terms.

- What if I lose my passport in Vietnam?If your Vietnam Travel Insurance policy includes coverage for loss of passport (e.g., TATA AIG offers up to $250), it will typically reimburse the expenses incurred in obtaining a duplicate or new passport. You must report the loss to the local police and the Indian Embassy.

Conclusion

A trip to Vietnam promises incredible memories for Indian travelers. Investing in comprehensive travel insurance for Vietnam is a small price to pay for significant peace of mind. It protects you from financial stress caused by unforeseen events like medical emergencies, baggage loss, or trip cancellations, allowing you to fully immerse yourself in the beauty and culture of Vietnam. Compare policies, understand the coverage and exclusions, secure your visa, and get insured before you fly!

READ MORE: